What do I do?

I collaborate with professionals and small business owners at various stages in their careers and lives, addressing gaps in their existing financial plans or initiating new ones as needed..

Common Questions

Some of the most common questions that I help answer are:

Am I saving enough to achieve my goals?

Whether we’re working together on short- or medium-term savings goals or tailoring a comprehensive retirement plan, my commitment remains unwavering. I recognize that financial planning extends beyond retirement, and I aim to be your partner throughout life’s journey.

Am I Investing in the most efficient way?

Taking a meticulous approach, I conduct detailed assessments to provide you with suitable investment strategies and explore various investment options. The key lies in selecting the right investments and aligning them with the appropriate account types. Drawing on my expertise, I help you strategize and prioritize which accounts and investments best suit your needs.

Let’s demystify financial acronyms: RRSPs (Registered Retirement Savings Plans), TFSAs (Tax-Free Savings Accounts), FHSAs (First Home Savings Accounts), RESPs (Registered Education Savings Plans), RDSPs (Registered Disability Savings Plans), RRIF (Registered Retirement Income Fund), LIRA ( Locked in Retirement Accounts) and LIF’s ( Life Income Fund) and Non-Registered accounts. Understanding these options allows us to maximize your tax efficiency.

Ultimately, my goal is to help you retain more of what you earn, ensuring financial well-being and peace of mind.

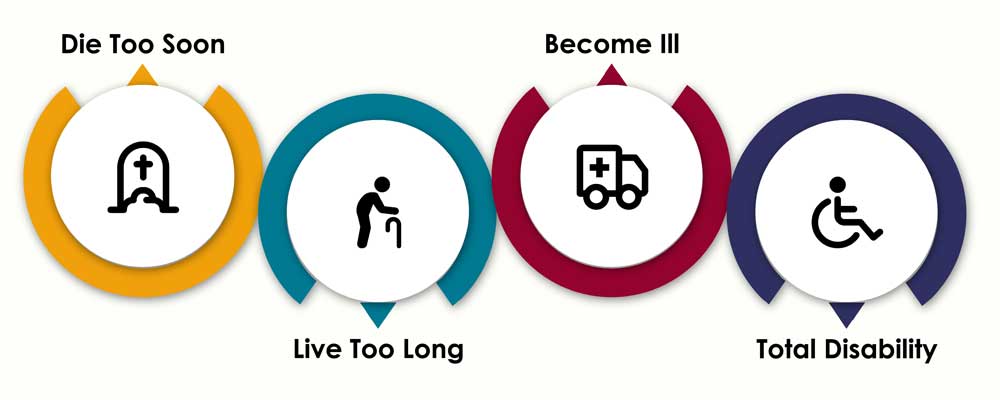

Major Reasons Of Having A Financial Plan For Insurance

What happens to my plan if my situation changes?

Life is full of unexpected twists, and safeguarding your future requires thoughtful planning. Imagine your ability to earn a living as your “golden goose.” It’s your most valuable asset. Have you considered what would happen if you were unable to work? Or if you were to pass away prematurely, leaving your family vulnerable? What if you faced critical illness but survived?

Fear not—I specialize in designing strategies to protect you during such pivotal moments. With appropriate disability, life, and critical illness insurance coverages, we can create a safety net. But that’s not all.

What is the best way to use my assets in retirement?

While retirement savings often steal the spotlight, planning for life after work is equally crucial. I’ll help you design a smart retirement income strategy, ensuring you access your savings wisely. And let’s not forget legacy planning—solutions to leave a lasting impact.

How do I do it?

In planning there is no such thing as one size fits all

Financial planning isn’t one-size-fits-all. No two individuals’ finances are identical. That’s why I make it my mission to understand your unique priorities. What matters most to you and your family? Let’s build strategies around those priorities, nurturing your wealth and security.

“If you fail to plan, you are planning to fail!”

― Benjamin Franklin

Why choose ND Financial?

Remember, I don’t just work for you; I work with you. My philosophy extends beyond guidance—it’s about education. Together, we’ll navigate the financial landscape, and I’ll be your trusted partner for life!

Lets get to work!